Table of Contents

Previous Surveys

Introduction

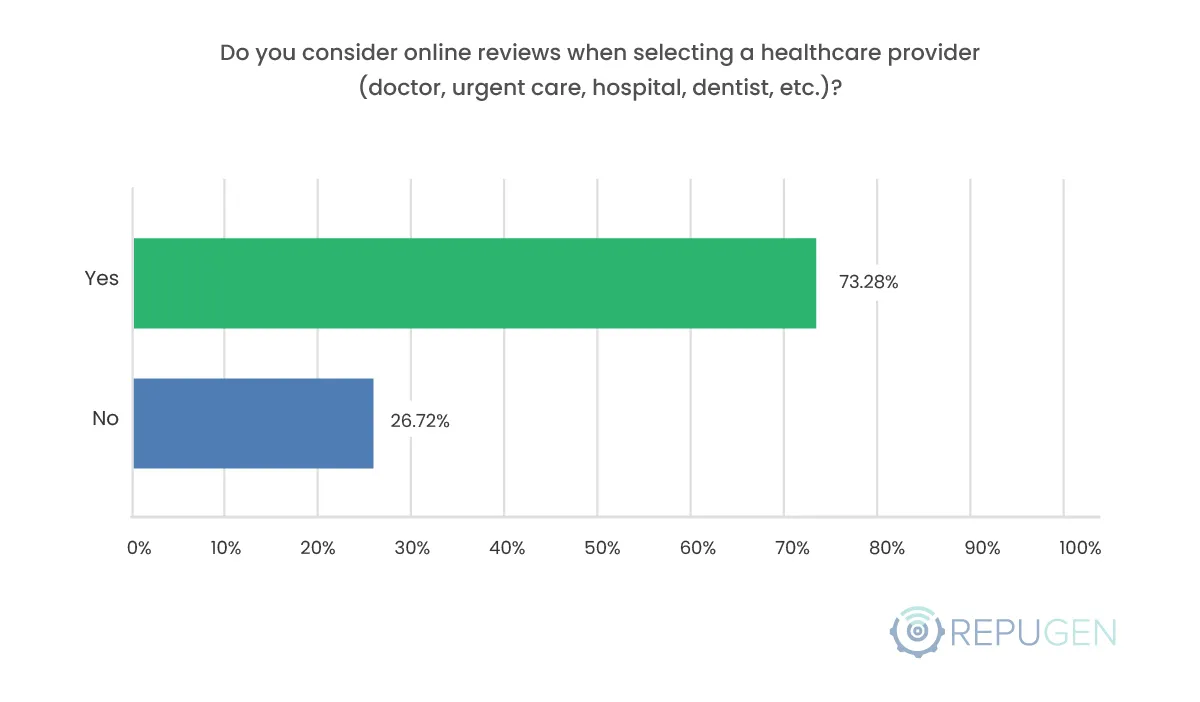

Online reviews heavily influence patient decisions, with 73.28% considering them when choosing a provider, making reputation management essential.

The RepuGen 2025 Patient Review Survey examines patient interactions with reviews, trust factors, and strategies for providers to enhance their online presence.

This report details survey demographics, key trends, and actionable strategies to strengthen healthcare providers’ reputation and patient trust in 2025.

Who We Surveyed: Demographics of the RepuGen 2025 Patient Review Survey

Our survey gathered responses from 1,212 individuals across diverse demographics, regions, and tech preferences, providing key insights into how different patient groups engage with online reviews and select healthcare providers.

Based on gender, women made up the majority of respondents 63.19%,while men accounted for 36.81%.The largest age group was 45-60 at 37.98%, followed by 30-44 at 24.12% and those 60 and older at 25.71%, highlighting the strong participation of older adults in online healthcare decisions. Younger adults aged 18-29 represented 12.18% of respondents, with minors under 18 excluded.

Smartphones dominated as the preferred research tool, with 53.78% using iOS devices and 39.58% relying on Android. Desktop and laptop usage was significantly lower, with only 4.62% on Windows and 1.93% on MacOS.

Household income distribution varied, with the largest segment at 38.49% earning between $25,000-$74,999, while 20.6% reported incomes above $100,000 and 16.72% with incomes below $25,000.

Geographically, this was conducted across the entirety of the United States, with the highest participating regions being from the South Atlantic (18.96%) and Pacific (17.77%) regions. The Middle Atlantic, East North Central, and West South Central areas also had strong representation, while New England, Mountain states, and East South Central had lower participation. U.S. Territories had minimal representation at 0.17%.

Key Themes and Findings

- Online reviews are important in healthcare provider selection, with 73.28% of patients considering them. Among these, 91.27% place a moderate or higher level of trust in online reviews.

- Star ratings and sentiment matter more than volume, as 55.56% overlook some negatives if ratings are high. Only 17.09% use AI tools for decisions.

- Patients prefer providers with a 4+ star rating.

- 40% consider reviews older than 1-2 years outdated.

- 59.48% trust providers more when they respond to reviews.

Provider Selection Factors

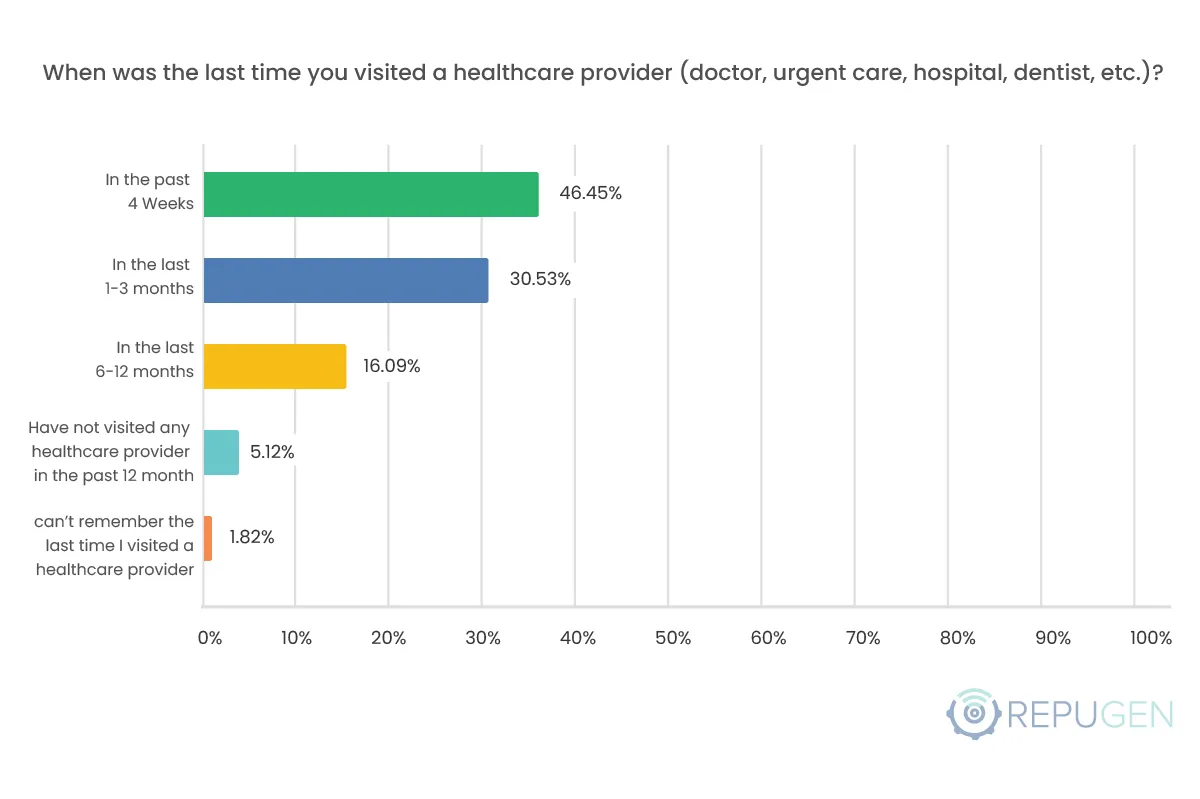

When was the last time you visited a healthcare provider (doctor, urgent care, hospital, dentist, etc.)?

Key Findings:

- High Recent Engagement: A dominant 46.45% of respondents have visited a healthcare provider (doctor, urgent care, hospital, dentist, etc.) within the past 4 weeks, demonstrating a very recent and active interaction with healthcare services.

- Consistent Recent Activity: Coupled with the 30.53% who visited within the last 1-3 months, we find that over 75% of respondents have had a healthcare experience within the immediate past quarter. This highlights a population actively engaged with the healthcare system.

- Limited Long-Term Inactivity: Only 5.12% of respondents have not visited a healthcare provider in the past 12 months, indicating a generally consistent engagement with healthcare services across the surveyed group.

Impact and Relevance:

This data establishes the crucial context for the entire RepuGen 2025 Patient Review Survey. The overwhelming majority of respondents are recent and active users of healthcare services. This means their perspectives on online reviews and provider selection are grounded in fresh, real-world experiences.

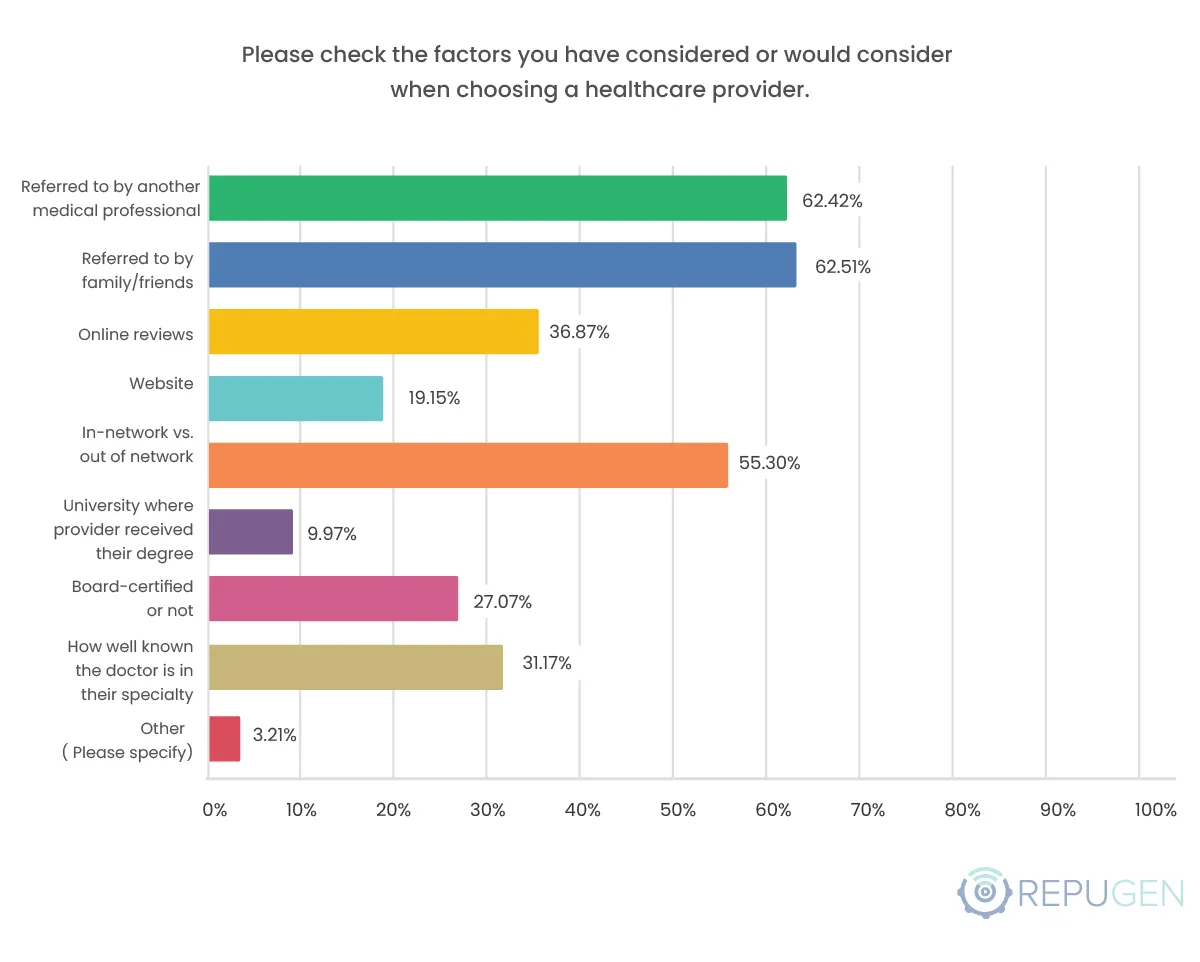

Please check the factors you have considered or would consider when choosing a healthcare provider.

Key Findings & Comparative Analysis (2024 vs. 2025):

- Referrals Show Steady Growth:

- Word-of-mouth (family/friends): 62.51% in 2025 (+2.40% from 60.11% in 2024)

- Medical professional referrals: 62.42% in 2025 (+4.34% from 58.08% in 2024)

- Insurance Considerations Spike:

- In-network coverage: 55.30% in 2025 (+6.54% from 48.76% in 2024)

- Online Reviews Dip Slightly:

- Online reviews: 36.87% in 2025 (-0.92% from 37.79% in 2024)

- Credentials Gain Importance:

- Board certification: 27.07% in 2025 (+3.70% from 23.37% in 2024)

- Doctor's reputation in specialty: 31.17% in 2025 (+4.27% from 26.90% in 2024)

- Stable Factors:

- Website importance: 19.15% in 2025 (-0.01% from 19.16% in 2024)

- University prestige: 9.97% in 2025 (-0.17% from 10.14% in 2024)

Possible Shifts:

Rising healthcare costs are driving a clear prioritization of insurance coverage, while a resurgence of trust in traditional referrals from family (+4.34% from 2024) and professionals (+2.4% from 2024) is evident. Concurrently, there's a potential shift away from sole reliance on online reviews, possibly due to concerns regarding fake reviews or a desire for more personalized information. Notably, patients are increasingly emphasizing the importance of provider credentials and expertise, indicating a move towards valuing tangible qualifications.

Inferences and Actionable Insights:

- Referral Networks: Trusted personal and professional referrals remain a key driver in patient choice. Providers should strengthen relationships with referring physicians and implement patient referral incentives to maximize this trend.

- Insurance Priority: With in-network coverage being a top concern, providers should simplify insurance verification, ensure accurate online listings, and consider expanding accepted plans to meet patient needs.

- Online Reviews Validation: Although slightly less influential with ~1% decrease from last year, online reviews still validate patient decisions. Automating review requests, responding professionally, and keeping online profiles updated can enhance digital reputation management.

- Online Reputation: A strong digital presence builds trust. Providers should highlight patient testimonials, physician credentials, and informative content to establish credibility and attract patients.

- Credentials Emphasis: Board certifications and physician reputation are increasingly important. Providers should prominently display credentials, awards, and expertise in marketing materials to appeal to informed patients.

- Patient Experience: Outstanding care drives referrals. Prioritizing patient satisfaction fosters word-of-mouth recommendations and strengthens a provider’s reputation.

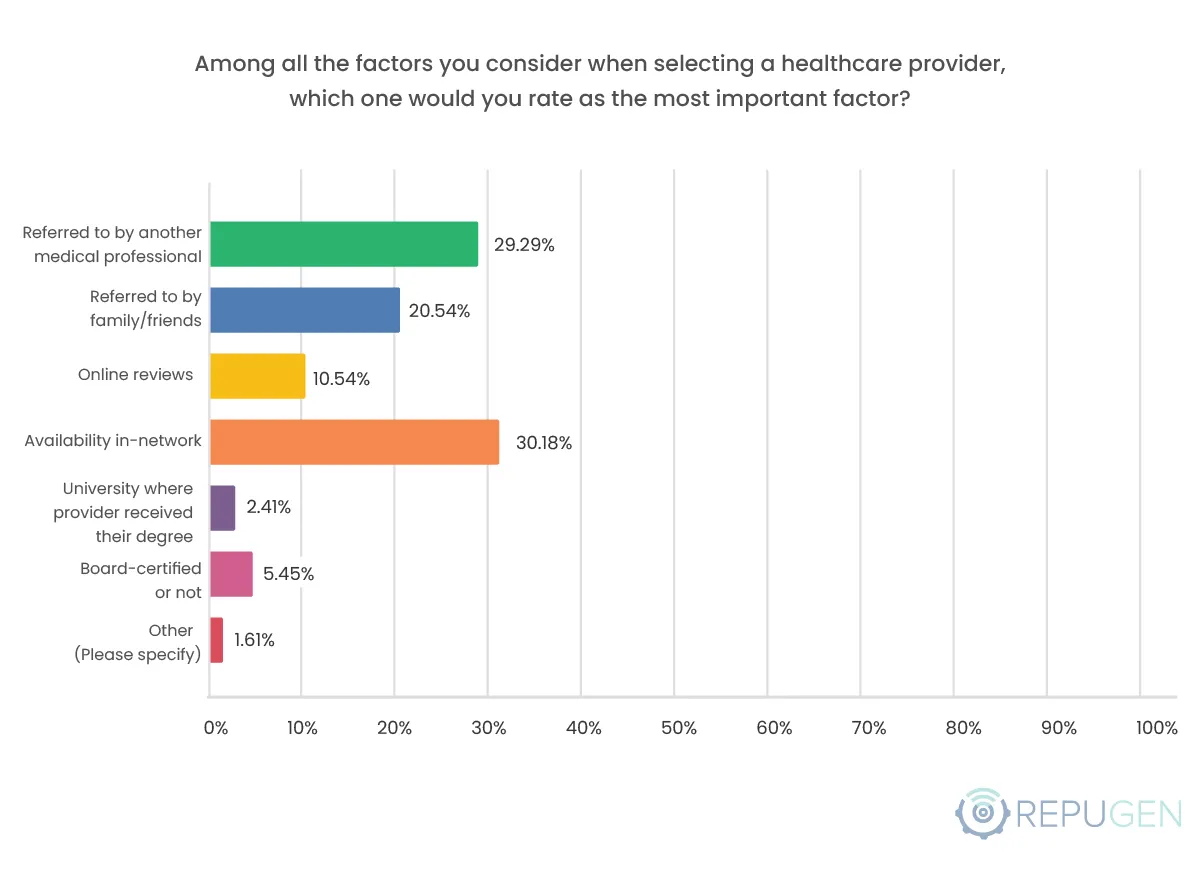

Among all the factors you consider when selecting a healthcare provider, which one would you rate as the most important factor?

Key Findings & Comparative Analysis (2024 vs. 2025):

- Insurance Emerges as Top Priority:

- In-network coverage: 30.18% in 2025 (+3.86% from 26.32% in 2024)

- Referrals Show Slight Decline:

- Medical professional referrals: 29.29% in 2025 (-0.73% from 30.02% in 2024)

- Family/friend referrals: 20.54% in 2025 (-0.88% from 21.42% in 2024)

- Online Reviews Lose Influence:

- Online reviews: 10.54% in 2025 (-2.58% from 13.12% in 2024)

- Credentials Gain Modestly:

- Board certification: 5.45% in 2025 (+0.47% from 4.98% in 2024)

- University prestige: 2.41% in 2025 (+0.22% from 2.19% in 2024)

Possible Shifts:

The data reveals patients are increasingly prioritizing practical concerns, with insurance coverage (+3.86%) overtaking professional referrals as the top factor. This suggests cost sensitivity is outweighing traditional trust networks in provider selection. Simultaneously, online reviews are losing influence (-2.58%), potentially due to growing skepticism about authenticity or their replacement by more tangible decision factors like insurance acceptance and credentials. The modest but consistent growth in credential importance (+0.47% board certification) indicates patients are becoming more sophisticated evaluators of provider quality.

Inferences and Actionable Insights:

- Insurance is Crucial: Cost, transparency, and accessibility remain top concerns, making in-network insurance a priority. Providers should simplify insurance verification, offer transparent pricing, and strategically manage network participation.

- Physician Referrals: Though slightly less influential than before, physician referrals are still vital for patient acquisition. Strengthening referral networks, tracking sources, and maintaining communication with referring doctors can sustain this valuable channel.

- Online Reviews Validation: Reviews validate patient choices across the board. While referred patients offer valuable reviews due to pre-existing trust, all patient reviews are crucial. Providers should actively seek and manage feedback from all patients to build a comprehensive and authentic online presence.

- Value and Affordability: Emphasizing the value within insurance networks, such as quality care, experience, and cost-effectiveness, can help attract and retain patients.

Trust and Influence of Online Reviews

Do you consider online reviews when selecting a healthcare provider (doctor, urgent care, hospital, dentist, etc.)?

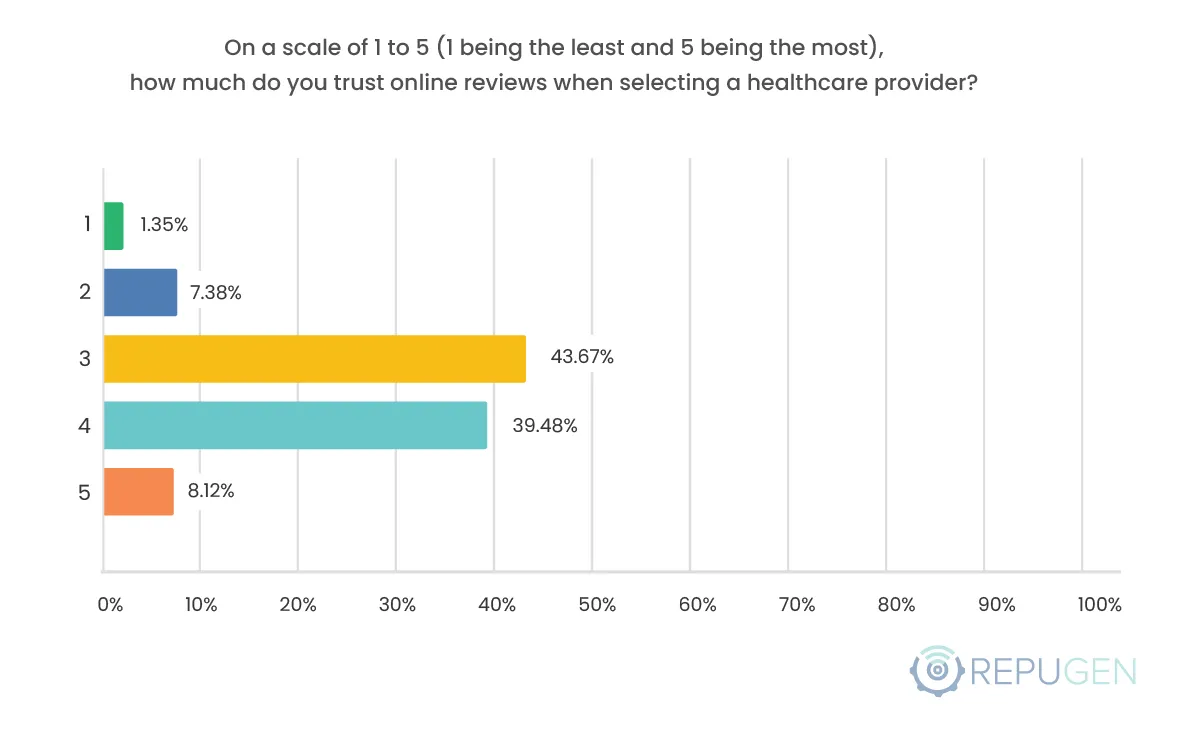

On a scale of 1 to 5 (1 being the least and 5 being the most), how much do you trust online reviews when selecting a healthcare provider?

Key Findings & Comparative Analysis (2024 vs. 2025):

- Review Consideration:

- Considers online reviews: 73.28% in 2025 (+0.57% from 72.71% in 2024)

- Does not consider reviews: 26.72% in 2025 (-0.57% from 27.29% in 2024)

- Review Factor Importance:

- Trust in reviews: 43.67% in 2025 (rating 3 out of 5)

- Very high trust (rating 5): 8.12% in 2025

- High trust (rating 4): 39.48% in 2025

- Moderate trust (rating 2): 7.38% in 2025

- Low trust (rating 1): 1.35% in 2025

Possible Shifts:

- Stable Review Consideration: The proportion of patients considering online reviews (73.28%) has remained stable, with only a slight increase of 0.57% from 2024. This indicates reviews continue to play a key role in decision-making.

- Growing Trust in Reviews: Although there has been a slight reduction in patients who trust reviews the most (rating 5), more patients are trusting reviews moderately (rating 3), showing increasing acceptance but still some caution.

- Increased Focus on Review Sentiment and Recency: The importance of review recency (from 8.42% to 14.02%) suggests that patients are more selective about how recent the reviews are, prompting providers to focus on gathering fresh feedback.

Inferences and Actionable Applications:

- Online Reviews Are Essential: The majority of patients (73.28%) still rely on online reviews. Providers should focus on automating review generation, monitoring sentiment, and responding to feedback.

- Increased Trust in Reviews: Trust in reviews is growing, with more patients trusting reviews moderately (rating 3). Providers should maintain high-quality care and respond to feedback to build credibility.

- Traditional Referrals Still Matter: Word-of-mouth and professional referrals remain key. Providers should strengthen physician relationships and incentivise patient referrals.

- Unified Reputation Strategy: Combining online reputation management with traditional referrals is effective. Providers should integrate reviews in offline materials and track both acquisition methods.

- Online Reputation Is Crucial: A strong online presence is vital for patient acquisition. Providers should focus on authenticity, care quality, and reputation management to stay competitive.

- Monitor Trends: Providers should stay updated on review trends and adjust strategies accordingly to maintain a solid online reputation.

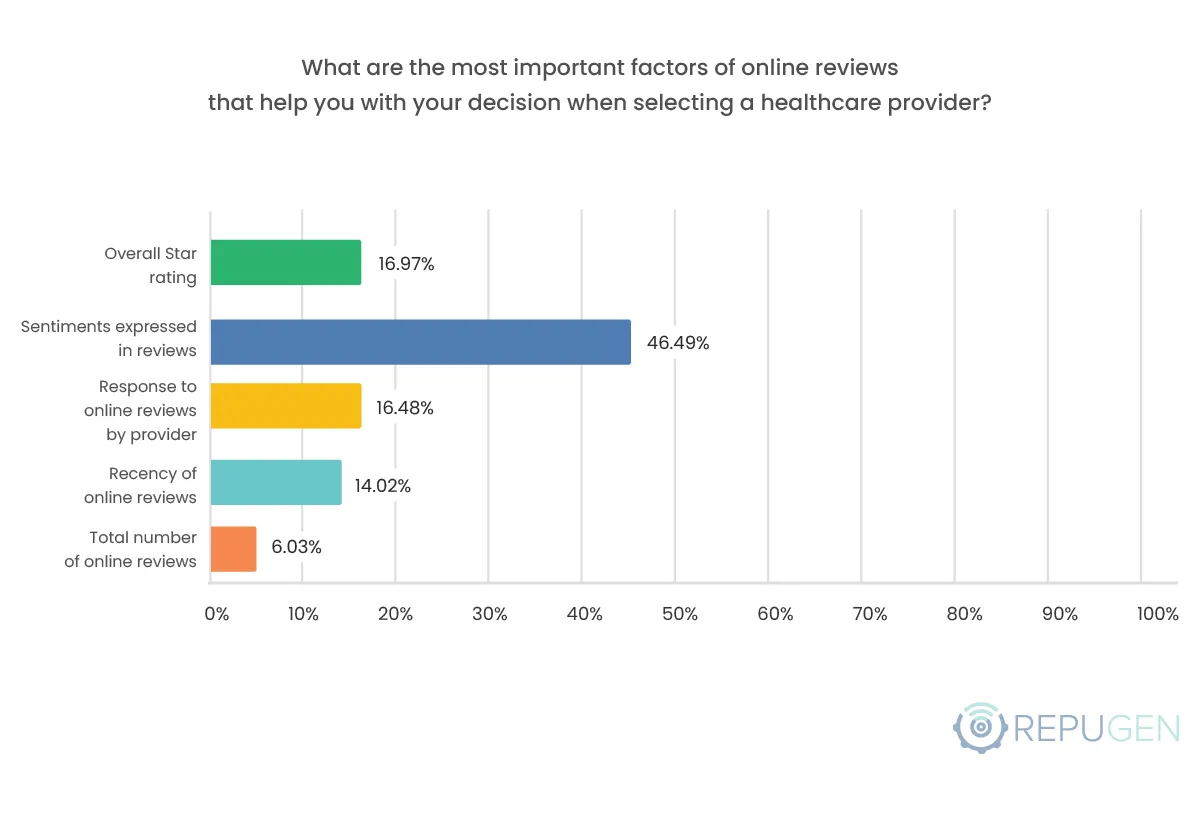

What are the most important factors of online reviews that help you with your decision when selecting a healthcare provider?

Key Findings & Comparative Analysis (2024 vs. 2025):

- Overall Star ratings: 16.97% in 2025 (-10.68% from 27.65% in 2024)

- Sentiments expressed in reviews: 46.49% in 2025 (-0.70% from 47.19% in 2024)

- Response to online reviews by providers: 16.48% in 2025 (+2.55% from 13.93% in 2024)

- Recency of online reviews: 14.02% in 2025 (+5.60% from 8.42% in 2024)

- Total number of online reviews: 6.03% in 2025 (+3.22% from 2.81% in 2024)

Possible Shifts:

Patients are becoming more sophisticated, prioritizing review content over ratings and valuing recent feedback. Provider responses and review volume are gaining importance, while star ratings serve as a basic quality indicator.

Inferences and Actionable Applications:

- Stories Over Stars: Patients prioritize review content over ratings. Providers should encourage narrative reviews with open-ended questions, showcase testimonials, and optimize content for SEO.

- Freshness Is Crucial: Recent reviews matter more than ever. Automate post-visit review requests, monitor trends, and highlight recent feedback on websites and platforms.

- Quality Over Quantity: Detailed, authentic reviews hold more weight than sheer numbers. Optimize review platforms and train staff to encourage specific, meaningful feedback.

- Don't Neglect Sentiment: While ratings matter less, review content remains key. Encourage patients to share detailed experiences for richer insights.

- Prioritize Recency: Maintain a steady flow of recent reviews by implementing automated post-visit feedback requests.

- Engage with Reviews: Prompt, professional responses show commitment to patient care and build trust. Prioritize engagement with all reviews.

- Maintain Review Volume: While quality is essential, a steady volume of reviews reinforces credibility. Encourage feedback across multiple platforms to sustain a strong online presence.

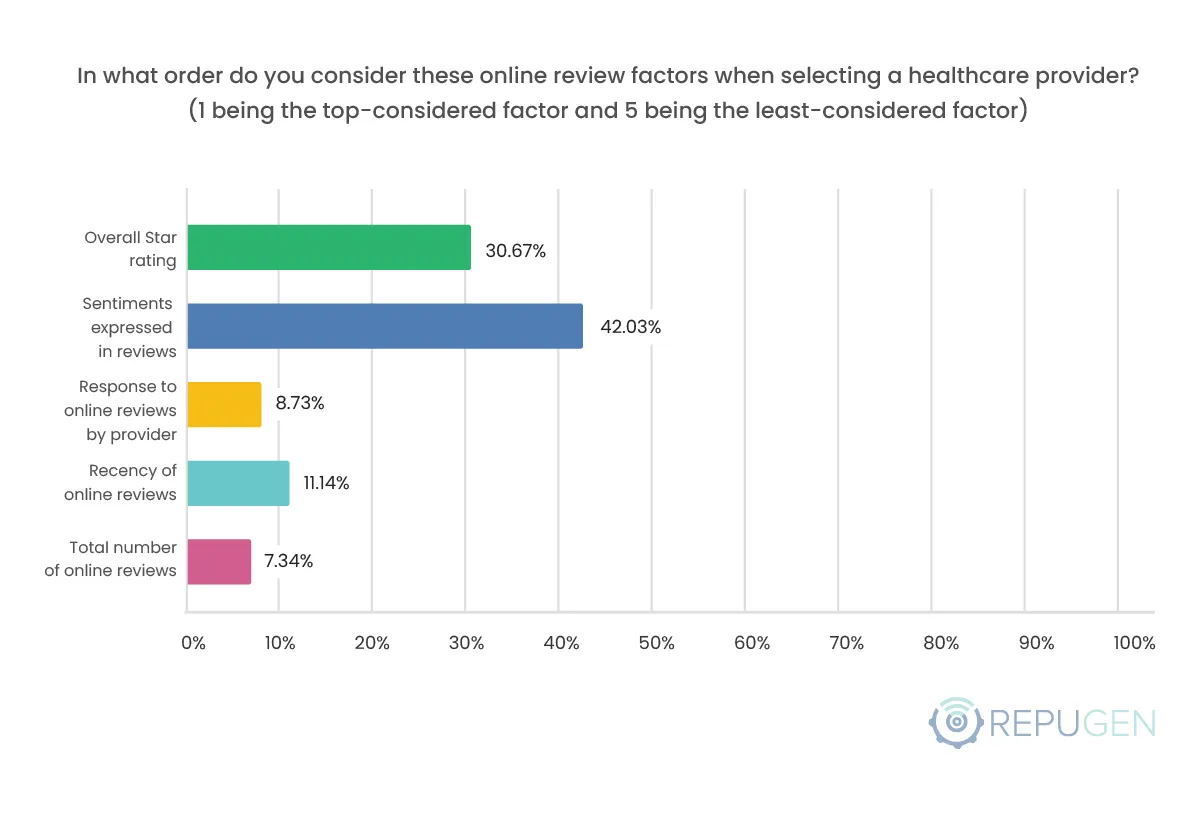

In what order do you consider these online review factors when selecting a healthcare provider? (1 being the top-considered factor and 5 being the least-considered factor)

Key Findings & Comparative Analysis (2024 vs. 2025):

Review Factor Scores (1-5 scale):

- Overall Star Rating: 3.55 in 2025 (-0.12 from 3.67 in 2024)

- Sentiment Expressed in Reviews: 3.76 in 2025 (no change from 3.76 in 2024)

- Response to Online Reviews: 2.53 in 2025 (-0.17 from 2.70 in 2024)

- Recency of Online Reviews: 2.82 in 2025 (+0.08 from 2.74 in 2024)

- Total Number of Online Reviews: 2.33 in 2025 (+0.20 from 2.13 in 2024)

Possible Shifts:

Patients are increasingly involved in their healthcare decisions, placing greater emphasis on recent, detailed patient experiences and provider interaction. Review volume and star ratings are becoming secondary indicators of provider quality.

Inferences and Actionable Applications:

- Content Over Quantity: Patients prioritize detailed reviews over sheer numbers. Encourage narrative-driven feedback, enhance patient experience, and analyze sentiments to improve services.

- Star Rating Is Still Crucial: While review content matters most, star ratings remain a quick trust indicator. Maintain a high average by addressing negative reviews and encouraging satisfied patients to leave ratings.

- Provider Responses Matter: Engagement influences perception. Respond thoughtfully to critical feedback, offer empathetic solutions, and acknowledge positive reviews with appreciation.

- Recency Is Key: Fresh reviews build credibility. Automate feedback requests, monitor outdated reviews, and highlight recent improvements in responses and website updates.

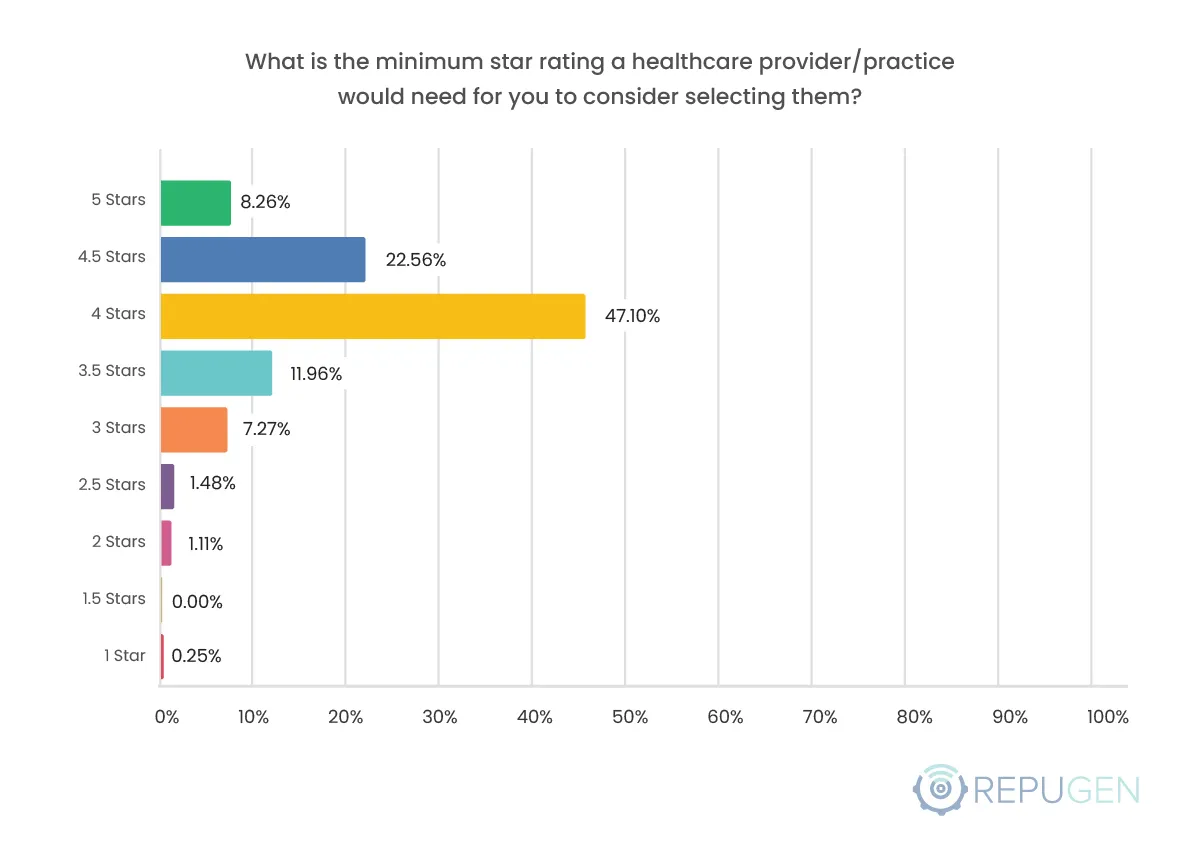

What is the minimum star rating a healthcare provider/practice would need for you to consider selecting them?

Key Findings & Comparative Analysis (2024 vs. 2025):

- 5 Stars: 8.26% in 2025 (-3.62% from 11.88% in 2024)

- 4.5 Stars: 22.56% in 2025 (-5.25% from 27.81% in 2024)

- 4 Stars: 47.10% in 2025 (+3.56% from 43.54% in 2024)

- 3.5 Stars: 11.96% in 2025 (-0.75% from 12.71% in 2024)

- 3 Stars: 7.27% in 2025 (+3.83% from 3.44% in 2024)

- 2.5 Stars: 1.48% in 2025 (new category)

- 2 Stars: 1.11% in 2025 (+0.69% from 0.42% in 2024)

- 1 Star: 0.25% in 2025 (+0.04% from 0.21% in 2024)

Possible Shifts:

The evolving trust in 4-star providers suggests patients are increasingly recognizing that excellent care can be found beyond perfect ratings, while broader acceptance of 3-star providers may stem from access needs, as patients prioritize timely care over perfect scores. Additionally, there's a shift towards valuing other review factors, such as sentiment, recency, and provider responses, indicating a more nuanced approach to evaluating online feedback beyond just star ratings.

Inferences and Actionable Applications:

- 4 Stars is the Gateway: A rating below 4 stars is a dealbreaker for many patients. Proactively monitor reputation, enhance patient experience, and establish service recovery processes to maintain a strong rating.

- Consistency Over Perfection: A steady 4+ star rating builds trust. Foster a culture of continuous improvement, invest in staff training, and track key performance indicators to ensure high service quality.

- Visibility Matters: A great rating only works if patients see it. Display ratings prominently on websites and review platforms, and manage online presence strategically.

- Star Ratings Still Screen Patients: While other factors matter, a strong rating remains a key filter. Maintain at least a 4-star average across all relevant platforms.

- Reputation Beyond Stars: Patients look beyond ratings to reviews and experiences. Prioritize generating positive, recent reviews that showcase quality care.

- Thoughtful Review Engagement: Responding to reviews both good and bad, demonstrates commitment to patient satisfaction. Address concerns and acknowledge feedback professionally.

- Excellent Care is the Core: A great reputation starts with great care. Focus on delivering outstanding patient experiences to naturally drive positive reviews and maintain high ratings.

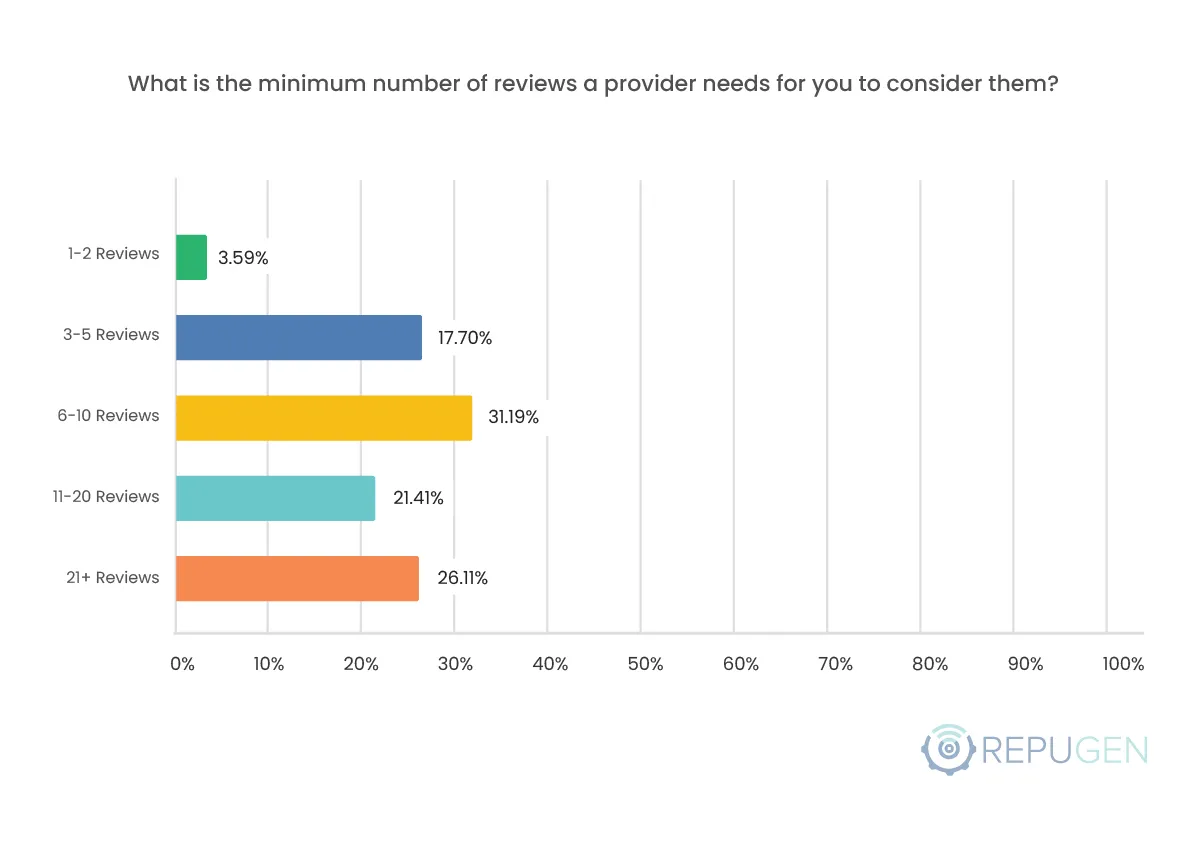

What is the minimum number of reviews a provider needs for you to consider them?

Key Findings:

- Moderate Review Requirement: 31.19% of patients need at least 6-10 reviews before considering a provider, indicating a baseline expectation for review volume.

- High Volume Preference: 26.11% of respondents prefer providers with 21+ reviews, demonstrating that a substantial portion of patients equate high review volume with trustworthiness.

- Low Review Amount = Skepticism: Only 3.59% of patients are willing to consider a provider with just 1-2 reviews, highlighting significant skepticism towards providers with minimal online feedback.

Inferences and Actionable Applications:

- More Reviews, More Trust: Few reviews can signal inexperience. Regularly request reviews via automated emails, SMS, or in-person prompts to build volume authentically.

- Credibility Comes with Volume: A high review count boosts trust. Encourage reviews across platforms, showcase them on your website, and highlight positive testimonials in marketing.

- Balance Matters: Patients value both positive and negative reviews. Encourage detailed feedback, respond professionally, and use criticism as an opportunity to improve.

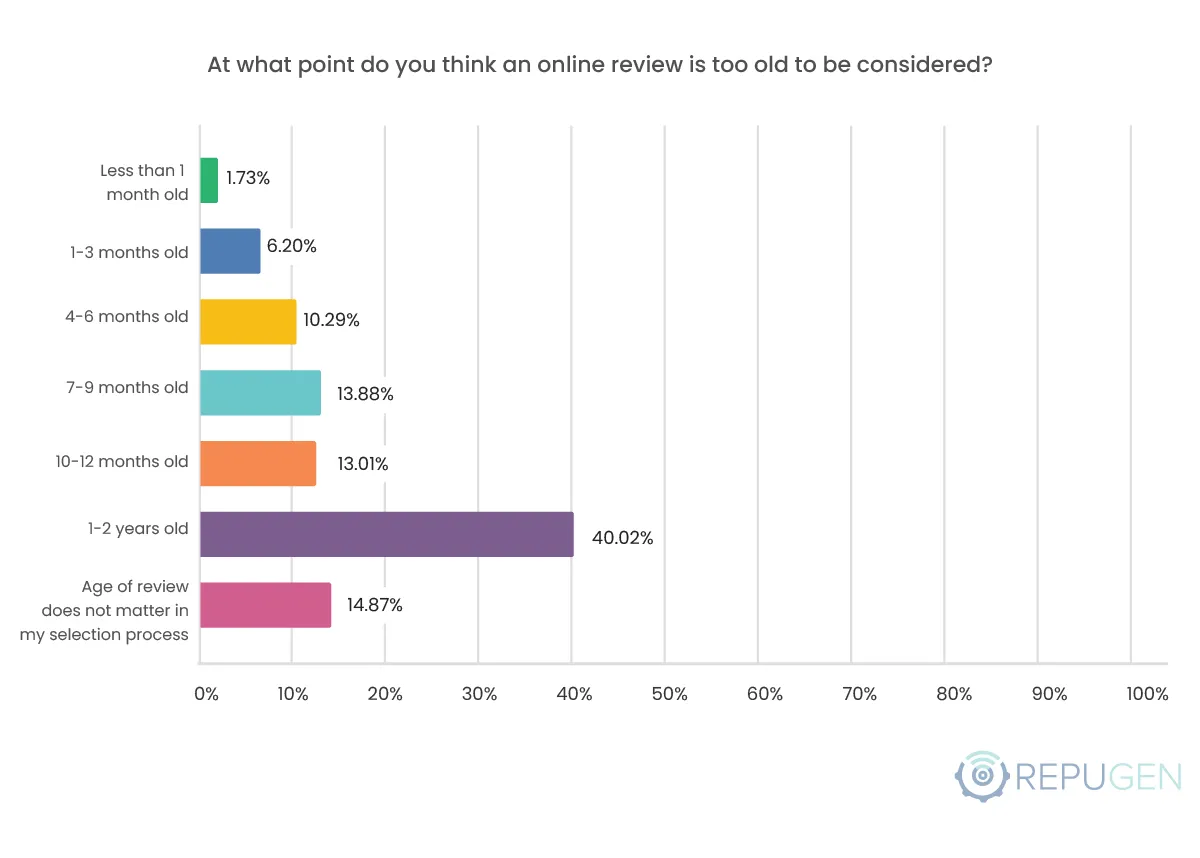

At what point do you think an online review is too old to be considered?

Key Findings & Comparative Analysis (2024 vs. 2025):

- Less than 1 month: 1.73% in 2025 (-1.61% from 3.34% in 2024)

- 1-3 months: 6.20% in 2025 (-4.85% from 11.05% in 2024)

- 3-6 months: 10.29% in 2025 (-3.89% from 14.18% in 2024)

- 6-9 months: 13.88% in 2025 (+0.12% from 13.76% in 2024)

- 9-12 months: 13.01% in 2025 (+1.33% from 11.68% in 2024)

- 1-2 years: 40.02% in 2025 (+8.74% from 31.28% in 2024)

- Age doesn't matter: 14.87% in 2025 (+0.17% from 14.70% in 2024)

- Reduced Demand for Recent Reviews:

- Reviews <1 month: -1.61%

- Reviews 1-3 months: -4.85%

- Reviews 3-6 months: -3.89%

- Increased Acceptance of Older Reviews:

- Reviews 1-2 years: +8.74% (now the largest segment at 40.02%)

- Reviews 9-12 months: +1.33%

Possible Shifts:

Patients are showing a nuanced understanding of healthcare review relevance. They are balancing the need for recent information with an understanding of healthcare consistency over time. Additionally, there could be review fatigue or differences in data collection that explain the difference in data.

Inferences and Actionable Applications:

- Recent Experiences Drive Decisions: Patients prioritize current feedback. Automate post-visit review requests, audit outdated reviews, and highlight recent reviews prominently.

- Continuous Feedback Maintains Reputation: Encourage frequent reviews via surveys and newsletters. Train staff to request feedback, and track review recency for consistency.

- Current Quality Matters Most: Focus on service excellence, address recurring issues, and respond to recent reviews promptly to show engagement.

- Consistency Builds Lasting Trust: Older reviews still shape reputation. Showcase long-term success stories while maintaining a steady flow of fresh feedback.

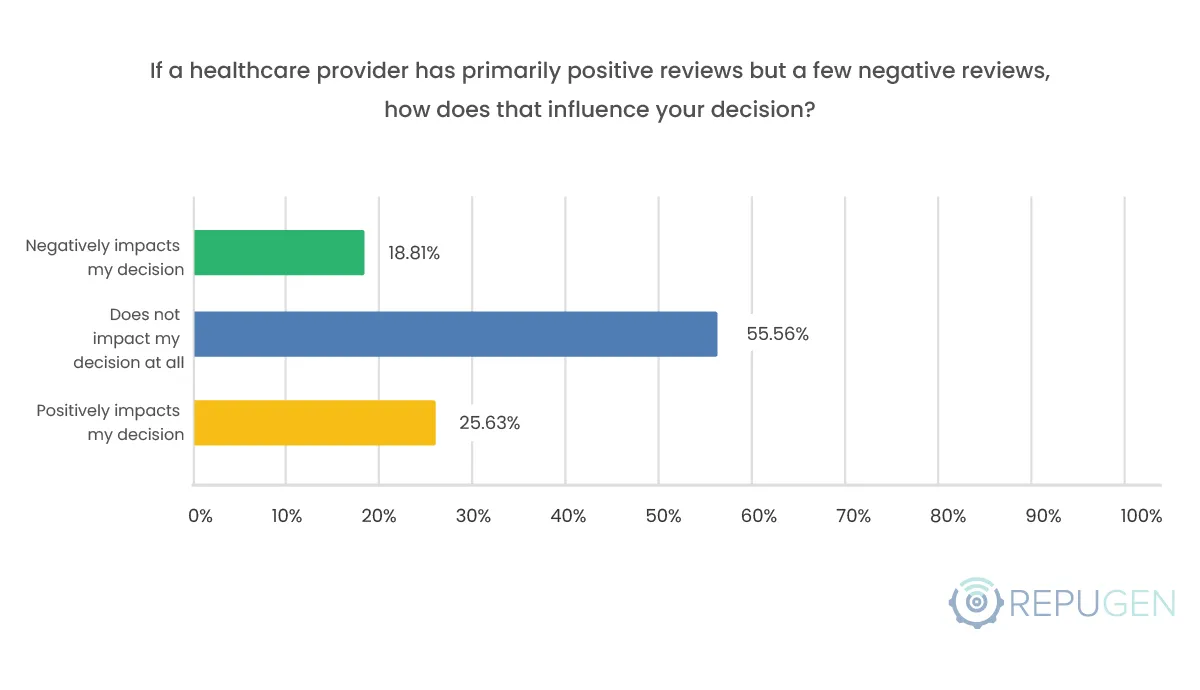

If a healthcare provider has primarily positive reviews but a few negative reviews, how does that influence your decision?

Key Findings:

- 55.56% of patients say a few negative reviews don't impact their decision.

Inferences and Actionable Applications:

- Perfection Isn’t Expected, Accountability Is: Patients care more about how you handle issues than avoiding them. Never delete negative reviews, respond thoughtfully and track recurring concerns.

- Responses Matter More Than Reviews: A professional, empathetic response can turn a negative review into a positive reflection of your commitment to care. Provide direct contact for resolutions.

- Authenticity Builds Trust: Honest feedback fosters credibility. Encourage balanced reviews and train staff to acknowledge mistakes transparently.

Review Platforms and Awareness

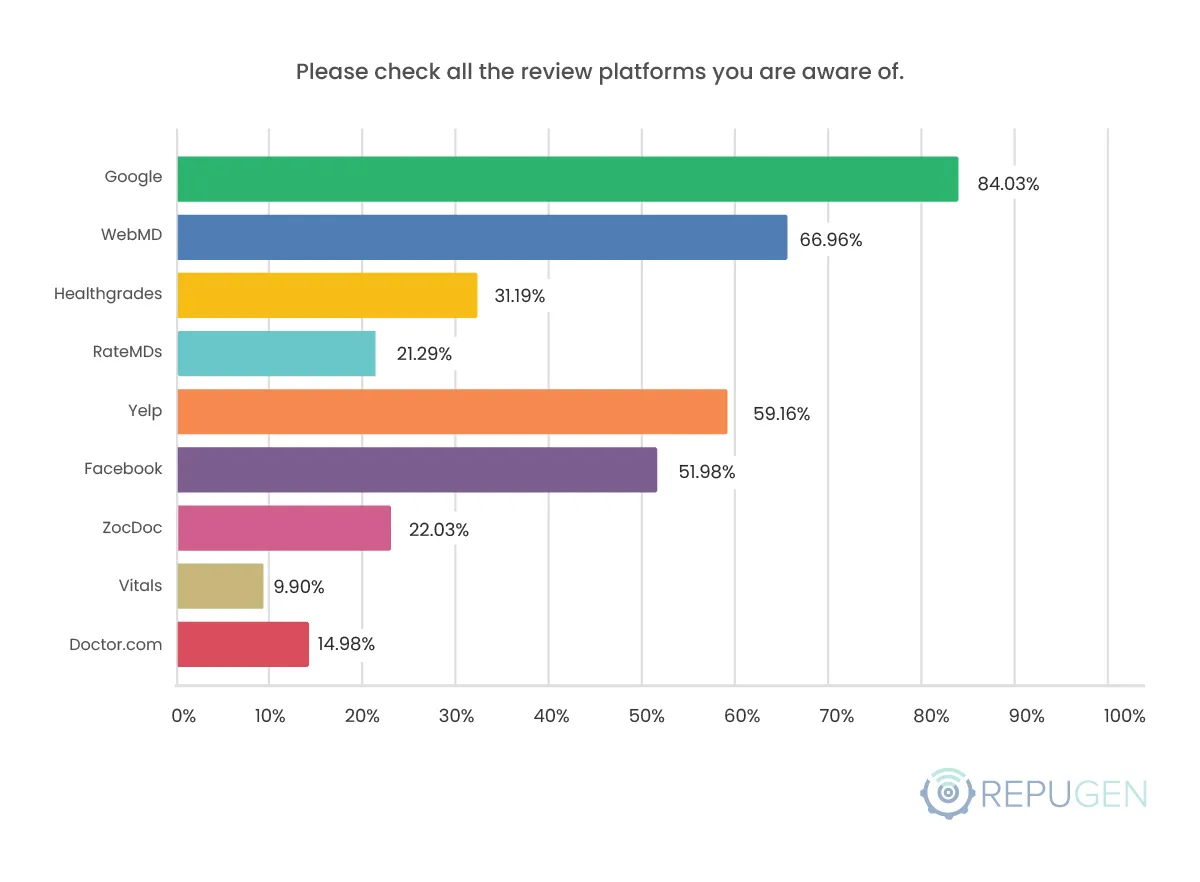

Please check all the review platforms you are aware of.

Key Findings & Comparative Analysis (2024 vs. 2025):

- Google maintains dominance at 84.03% awareness in 2025 (+2.07% from 81.96% in 2024), solidifying its position as the essential review platform.

- WebMD shows the most dramatic growth at 66.96% in 2025 (+8.98% from 57.98% in 2024), emerging as the clear second-choice platform for healthcare reviews.

- Yelp demonstrates remarkable expansion to 59.16% in 2025 (+11.40% from 47.76% in 2024), indicating its successful push into healthcare reputation management.

- Facebook crosses the majority threshold at 51.98% in 2025 (+6.10% from 45.88% in 2024), becoming increasingly relevant for healthcare decisions.

- RateMDs grows substantially to 21.29% in 2025 (+4.81% from 16.48% in 2024), showing potential as an emerging niche platform.

- HealthGrades maintains a steady presence at 31.19% in 2025 (+1.58% from 29.61% in 2024), continuing its role as a specialized healthcare review site.

- ZocDoc shows modest growth to 22.03% in 2025 (+2.01% from 20.02% in 2024), maintaining its appointment-focused review system.

- Vitals reach 9.90% in 2025 (+1.45% from 8.45% in 2024), showing slower growth compared to major platforms.

- Doctor.com grows slightly to 14.98% in 2025 (+1.11% from 13.87% in 2024), indicating stable but limited adoption.

Possible Shifts:

Increased platform marketing and visibility are driving changes in patient behavior, with more patients using specific platforms for healthcare information. Platform enhancements and normal survey variations are also contributing factors.

Inferences and Actionable Applications:

- Google Dominates Patient Research: Optimize your Google Business Profile, actively request Google reviews, and monitor/respond frequently.

- Niche Platforms (WebMD & Healthgrades) Matter: Ensure profiles are complete, accurate, and regularly updated. Encourage patient reviews on these trusted platforms.

- Yelp Influences Decisions: Maintain an accurate Yelp profile and manage patient interactions effectively.

- Multi-Platform Presence Expands Reach: Monitor and optimize profiles on Facebook, Vitals, and other relevant platforms for consistency.

- Prioritize Key Platforms Strategically: Focus efforts on Google, WebMD, Yelp, and Healthgrades. Adapt strategies based on platform trends and audience demographics.

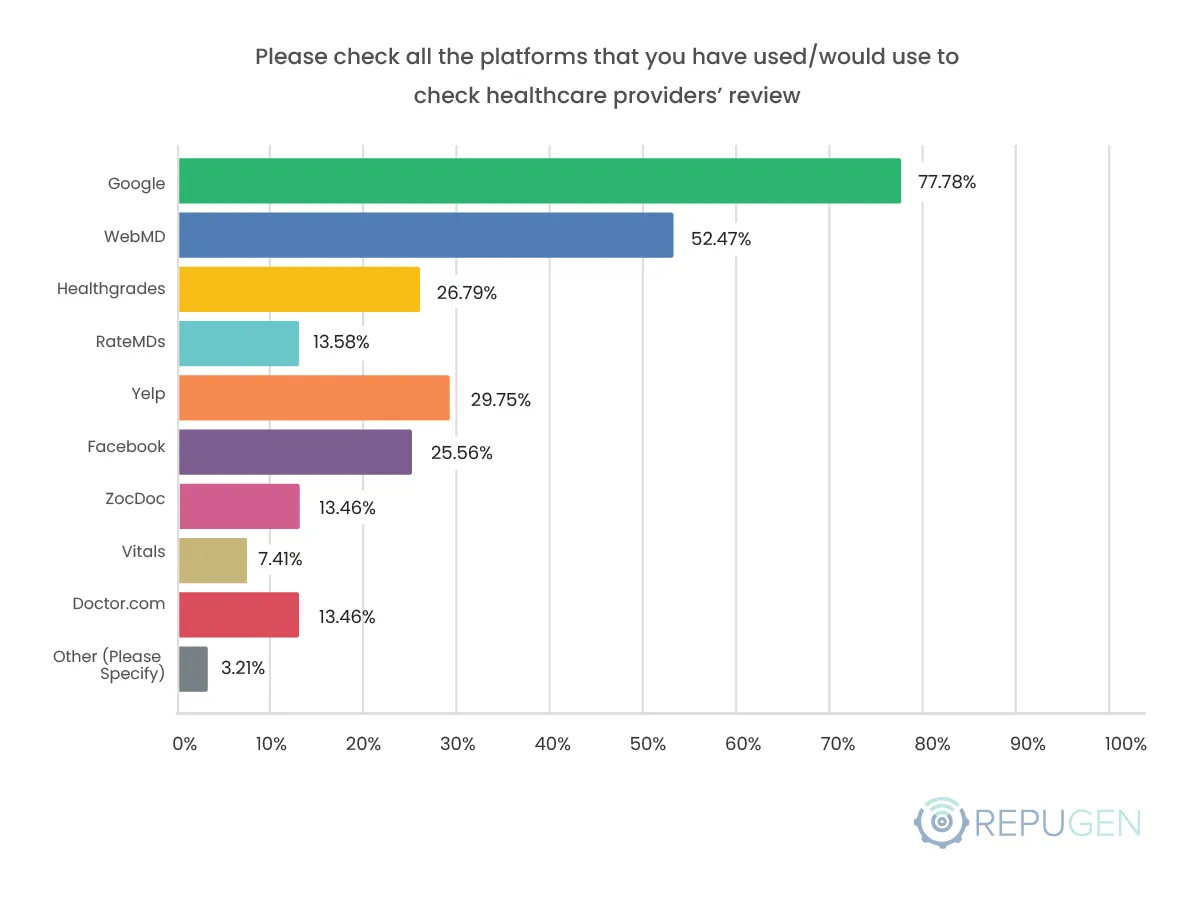

Please check all the platforms that you have used/would use to check healthcare providers’ review

Key Findings & Comparative Analysis (2024 vs. 2025):

- Google strengthens its lead with 77.78% usage in 2025 (+2.41% from 75.37% in 2024), maintaining its position as the dominant healthcare review platform.

- WebMD shows steady growth at 52.47% in 2025 (+3.72% from 48.75% in 2024), confirming its role as a trusted medical information source.

- HealthGrades maintains stable usage at 26.79% in 2025 (+0.90% from 25.89% in 2024), continuing as a specialist healthcare review site.

- RateMDs grew to 13.58% in 2025 (+2.10% from 11.48% in 2024), showing increased adoption among patients.

- Vitals demonstrates notable growth to 7.41% in 2025 (+2.50% from 4.91% in 2024), though remaining a smaller player.

- Doctor.com sees slight growth to 13.46% in 2025 (+0.52% from 12.94% in 2024), maintaining its niche position.

- Other platforms collectively increase to 3.21% in 2025 (+2.06% from 1.15% in 2024), suggesting diversification.

- Yelp experiences a slight decrease to 29.75% in 2025 (-0.42% from 30.17% in 2024), its first decline in recent years.

- Facebook shows a more significant reduction to 25.56% in 2025 (-2.83% from 28.39% in 2024), potentially due to privacy concerns.

- ZocDoc remains stable at 13.46% in 2025 (-0.21% from 13.67% in 2024), with negligible change.

Possible Shifts:

The data reveals a gradual consolidation around established healthcare platforms, with Google (+2.41%) and WebMD (+3.72%) strengthening their positions as core resources, while social media-linked platforms like Facebook (-2.83%) show declining relevance. The modest growth of specialized medical sites like HealthGrades (+0.9%) and RateMDs (+2.1%) suggests patients are increasingly distinguishing between general review platforms and healthcare-specific sources. Notably, Yelp's slight decline (-0.42%) after years of growth may indicate saturation in its healthcare vertical, while the emergence of smaller platforms (Other +2.06%) points to fragmentation in the long-tail of review options. This shift toward trusted medical platforms over social media reflects growing patient sophistication in seeking specialized healthcare information.

Inferences and Actionable Applications:

- Double Down on Google & WebMD: With Google (77.78%) and WebMD (52.47%) showing steady growth, providers should prioritize these platforms for reputation management. Ensure profiles are complete, respond to reviews promptly, and encourage satisfied patients to leave feedback.

- Optimize for Healthcare-Specific Platforms: The growth of RateMDs (+2.1%) and HealthGrades (+0.9%) suggests patients trust niche medical review sites. Claim and update profiles on these platforms to attract more informed patients.

- Reassess Facebook & Yelp Strategy: Facebook’s decline (-2.83%) and Yelp’s stagnation (-0.42%) indicate these platforms may be losing relevance for healthcare decisions. Shift focus away from broad social platforms unless targeting specific demographics.

- Monitor Emerging Platforms: The rise in "Other" platforms (+2.06%) signals potential new players in the space. Stay alert to shifts in patient behavior and adapt review strategies accordingly.

- Leverage Vitals’ Growth: Vitals’ notable increase (+2.5%) makes it worth maintaining an updated profile, especially for specialists seeking targeted visibility.

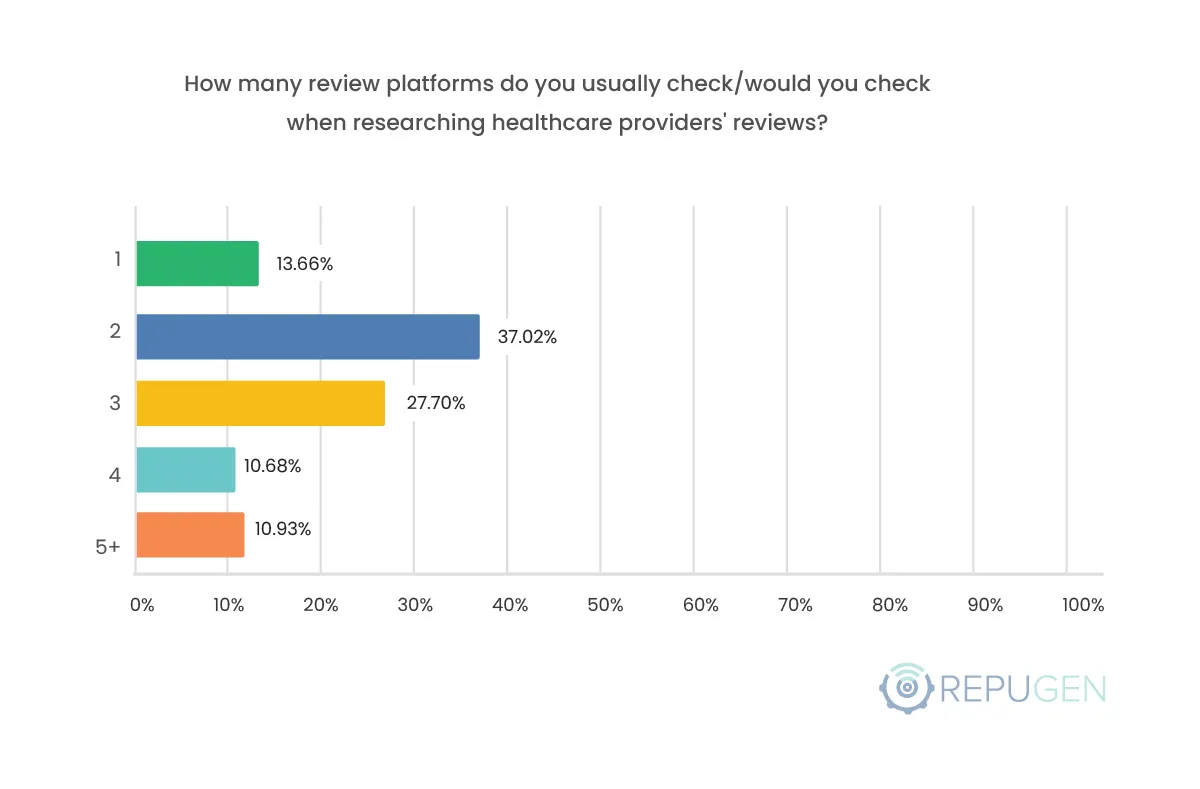

How many review platforms do you usually check/would you check when researching healthcare providers' reviews?

Key Findings & Comparative Analysis (2024 vs. 2025):

- 1 Platform: 13.66% in 2025 (-0.22% from 13.88% in 2024); Minimal decline in single-platform reliance.

- 2 Platforms: 37.02% in 2025 (+0.69% from 36.33% in 2024); Remains the most common research depth.

- 3 Platforms: 27.70% in 2025 (+0.87% from 26.83% in 2024); Growing segment of thorough researchers.

- 4 Platforms: 10.68% in 2025 (-0.07% from 10.75% in 2024); Slight dip in extensive checking.

- 5+ Platforms: 10.93% in 2025 (-1.28% from 12.21% in 2024); Fewer patients conduct exhaustive searches.

Possible Shifts:

Patients are increasingly conducting thorough research, cross-referencing information across multiple review platforms to make informed decisions.

Inferences and Actionable Applications:

- Patients Cross-Reference Reviews: Maintain a strong presence on Google, WebMD, Healthgrades, and Yelp. Ensure consistent and accurate business details across platforms.

- Holistic Reputation Management is Essential: Monitor all review platforms, respond to feedback everywhere, and develop a strategy for review generation and negative feedback handling.

- Patients Conduct Thorough Research: Optimize profiles with detailed service info, physician bios, and engaging visuals. Use content marketing (blogs, videos) to showcase expertise.

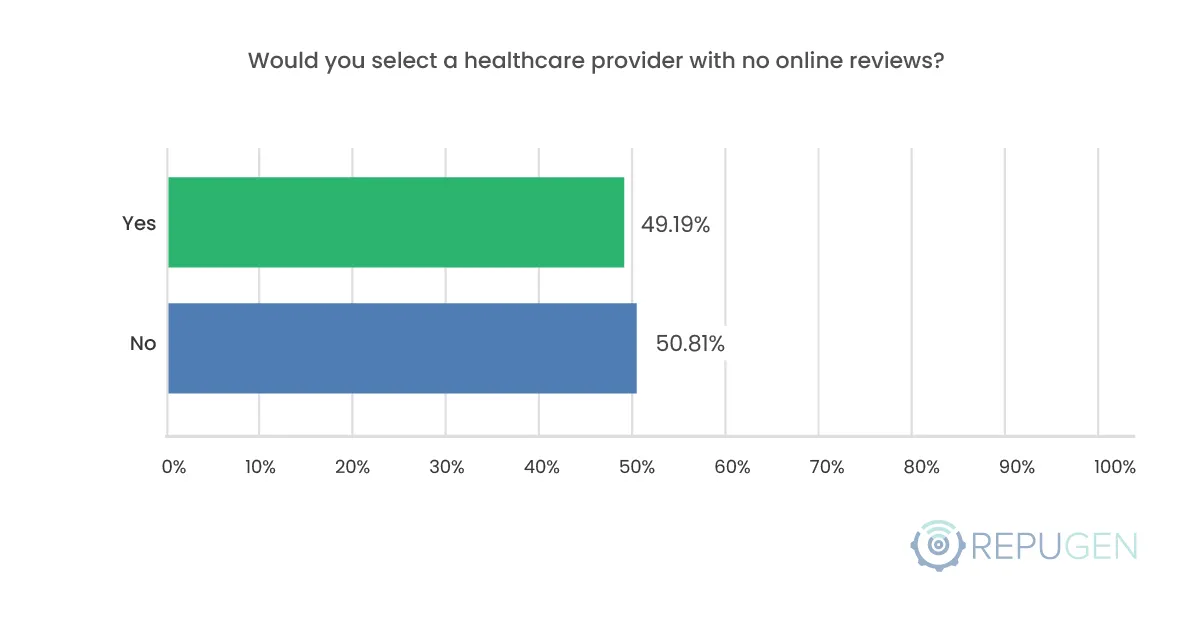

Would you select a healthcare provider with no online reviews?

Key Findings & Comparative Analysis (2024 vs. 2025):

- Yes: 49.19% in 2025 (-6.19% from 55.38% in 2024); Significant decline in patient openness.

- No: 50.81% in 2025 (+6.19% from 44.62% in 2024); Majority now avoid providers lacking reviews.

Possible Shifts:

Patients are increasingly relying on online reviews, demonstrating greater platform awareness. Reviews are now viewed as a sign of transparency, and their presence is becoming a standard expectation.

Inferences and Actionable Applications:

- No Reviews = Distrust: Lack of reviews raises suspicion. Simplify the review process and focus on generating patient feedback.

- New Providers Face a Credibility Gap: Encourage early reviews with a “first reviewer” campaign and leverage testimonials to build trust.

- No Reviews = Lost Patients: Patients often filter out providers with no reviews. Train staff to request reviews and highlight credentials.

- Online Reviews Are Essential: Address the lack of reviews with transparency and prioritize proactive review management.

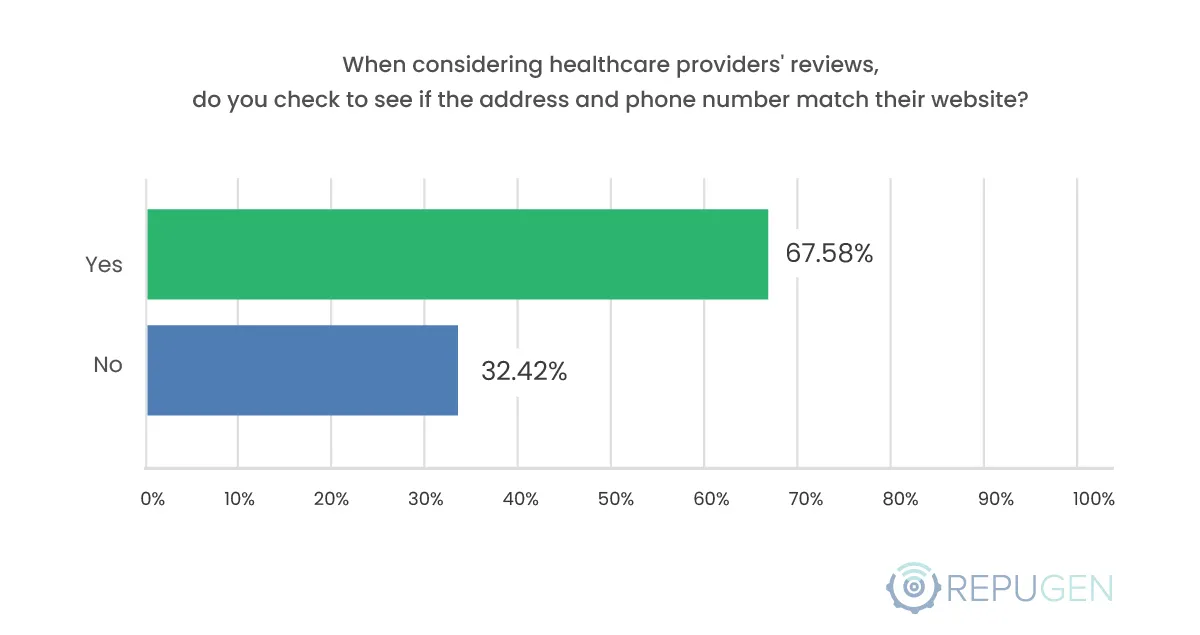

When considering healthcare providers' reviews, do you check to see if the address and phone number match their website?

Key Findings & Comparative Analysis (2024 vs. 2025):

- Yes: 67.58% in 2025 (-6.92% from 74.50% in 2024) – Notable decline in verification behavior.

- No: 32.42% in 2025 (+6.92% from 25.50% in 2024) – Growing segment skipping this step.

Possible Shifts:

Patients are placing increased trust in review platforms, while also prioritizing review sentiment and provider responses. Convenience, time constraints, mobile usage, and assumed accuracy are also influencing factors.

Inferences and Actionable Applications:

- Consistency Builds Trust: Ensure NAP (Name, Address, Phone) consistency across all platforms to avoid raising doubts among prospective patients.

- Patients Verify Legitimacy: Make contact info easy to find and mobile-friendly to build trust.

- Accuracy Is Crucial: Even minor discrepancies can undermine a healthcare provider's credibility. Patients rely on this information for communication and verification, and discrepancies suggest a lack of attention to detail, raising concerns about overall care quality.

- Focus on Review Sentiment: Quality and sentiment of reviews matter more than just star ratings.

- Streamline Contact Info: Ensure clear, easy-to-access contact details on websites and profiles.

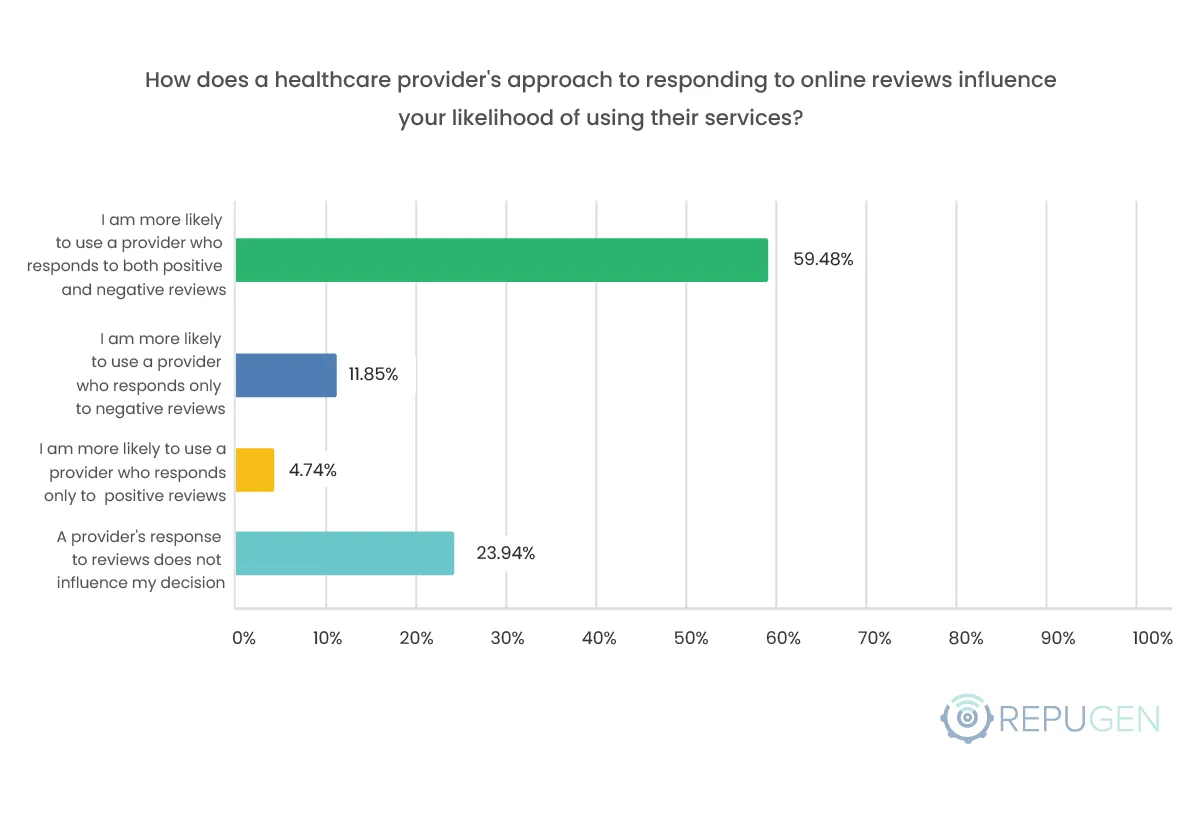

How does a healthcare provider's approach to responding to online reviews influence your likelihood of using their services?

Key Findings:

- 59.48% of patients are likely to choose a provider who responds to positive and negative reviews.

Inferences and Actionable Applications:

- Engagement Signals Care: Timely (24-48 hours) and thoughtful responses show you value patient feedback.

- Establish Clear Guidelines: Define tone (professional, empathetic), key response points, and assign a dedicated team to monitor reviews.

- Personalization Builds Trust: Avoid generic responses, reference specific details from the review to foster authenticity.

- Acknowledge & Resolve Issues: Thank positive reviewers and address concerns with empathy. Offer offline resolutions when needed.

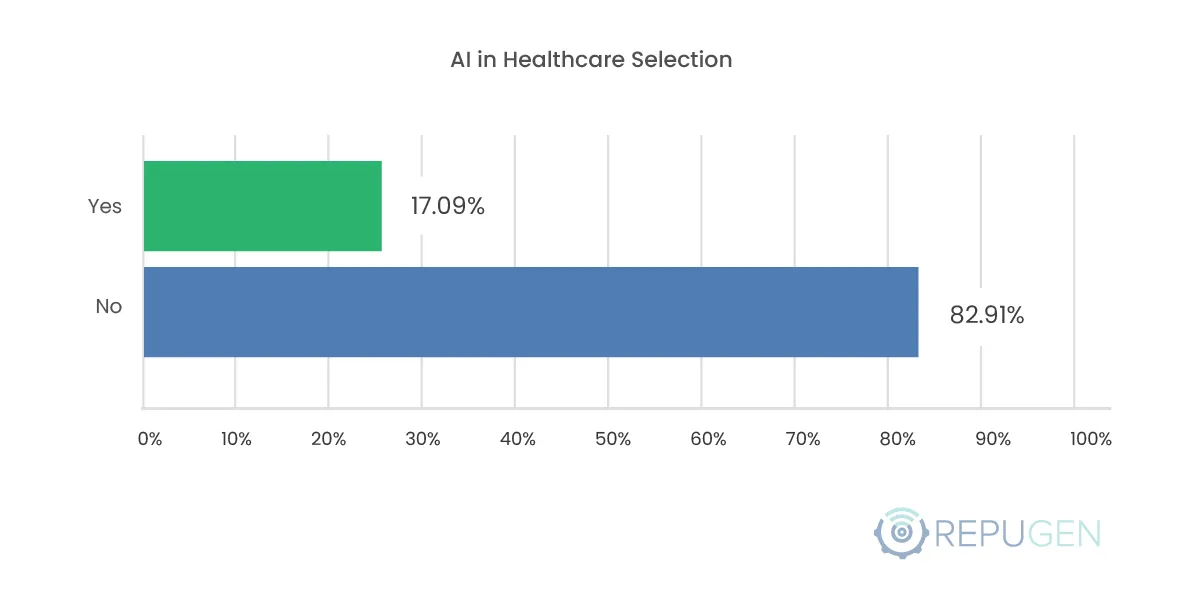

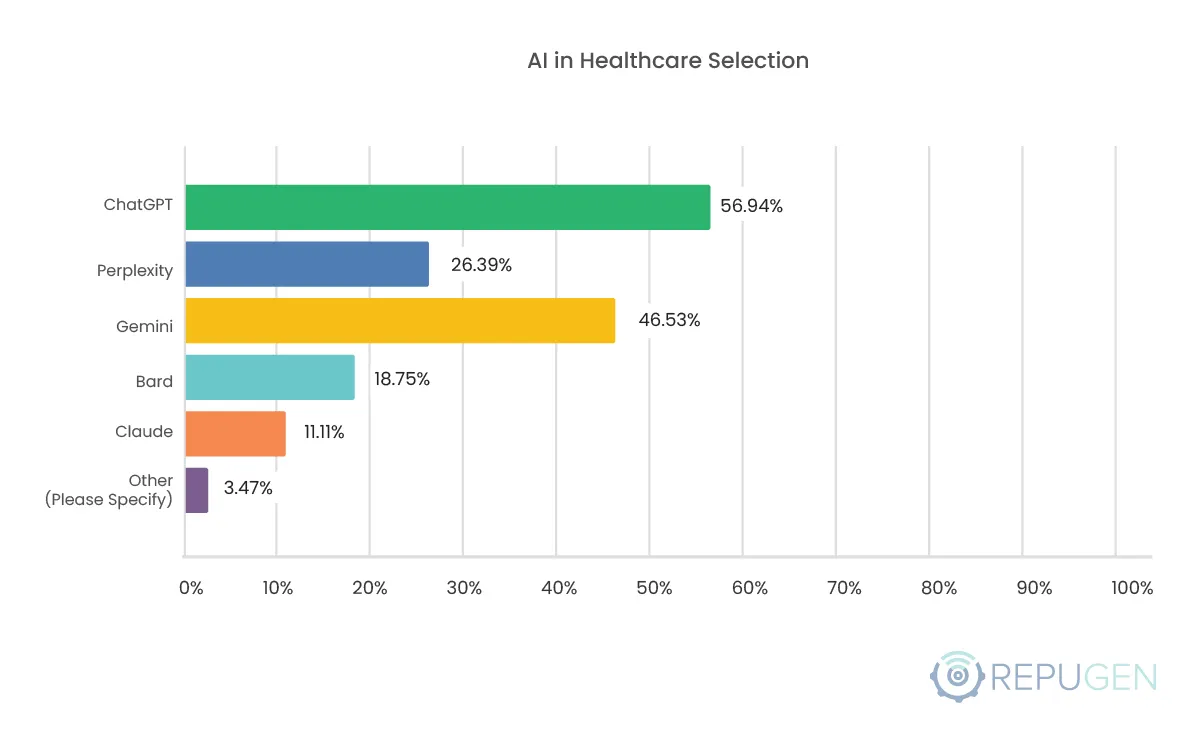

AI in Healthcare Selection

Do you use AI when searching for a healthcare provider and if so, which ones?

Key Findings:

- Only 17.09% of patients currently use AI-based tools to aid their decision-making.

Inferences and Actionable Applications:

- AI is Transforming Healthcare: While still emerging, AI’s role in reputation management is growing. Stay ahead by exploring AI-powered tools and pilot programs.

- Patient Behavior is Evolving: AI-driven search will influence patient decisions. Optimize website content with structured data, long-tail keywords, and mobile-friendly design.

- AI Enhances Reputation Management: AI can automate review monitoring, sentiment analysis, and responses. Leverage AI for efficiency while maintaining personalized engagement.

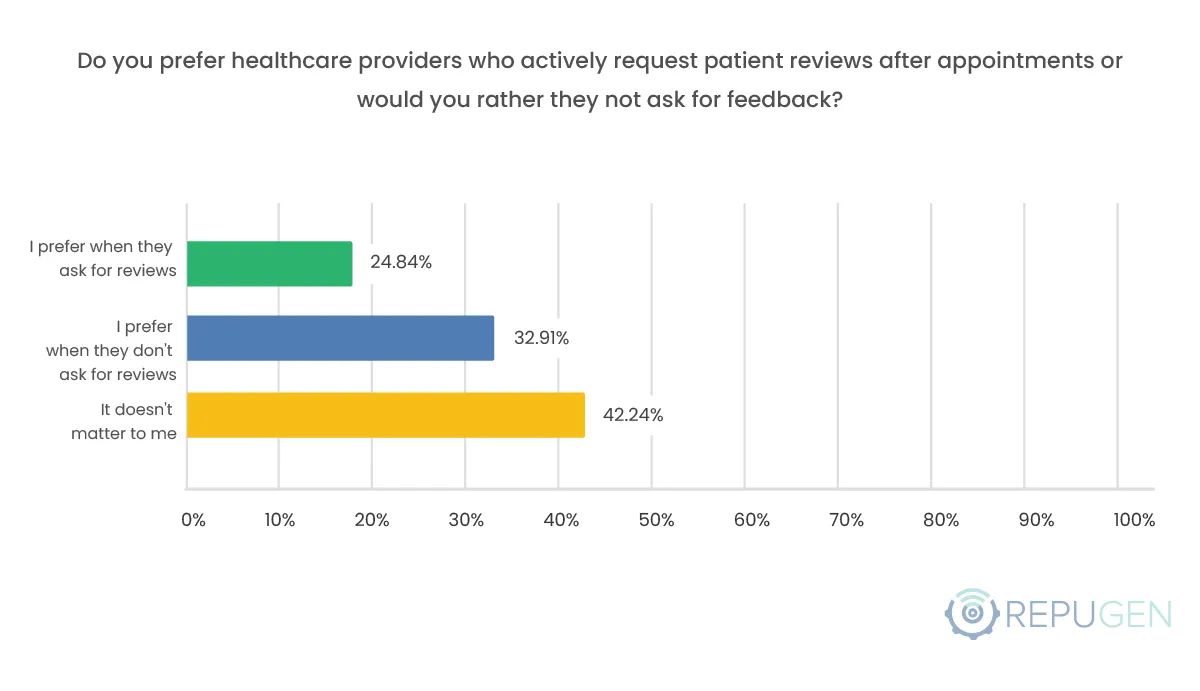

Do you prefer healthcare providers who actively request patient reviews after appointments or would you rather they not ask for feedback?

Key Findings:

- 24.84% of patients prefer it when healthcare providers actively ask for reviews.

Inferences and Actionable Applications:

- Patients Appreciate Proactive Feedback Requests: Automate post-visit review requests via email, SMS, or app notifications. Test different timing strategies to maximize response rates.

- Personalization Matters: Avoid aggressive requests, use patient names and reference their visit. Explain how feedback improves care and offer multiple review options (surveys, direct forms, or online reviews).

- Simplify the Review Process: Provide direct links and QR codes for easy access. Ensure mobile-friendly submissions and let patients choose preferred platforms (Google, Healthgrades, etc.).

Summary

Online reviews are now a fundamental part of healthcare decisions, with 73.28% of patients relying on them. Key findings show that 70% of patients require a minimum of 4 stars, 57.3% need 6-10+ reviews for trust, 40% consider reviews older than 1-2 years outdated, and 59.48% prefer providers who respond to reviews. This means that online reputation is a competitive necessity for healthcare providers, requiring active solicitation of recent, detailed reviews and responses to all feedback.

Ultimately, a strong digital reputation built through proactive online engagement and reputation management is essential for future success in the evolving healthcare landscape.